Axcelis Technologies and Veeco Instruments have both secured stockholder approval for their previously announced merger, aimed at establishing a major entity in the semiconductor equipment industry, valued at approximately $4.4bn.

This all-stock transaction is set to complete in the second half of 2026.

Initially announced in October 2025, the merger is projected to create a robust presence in the market by combining the strengths of both companies.

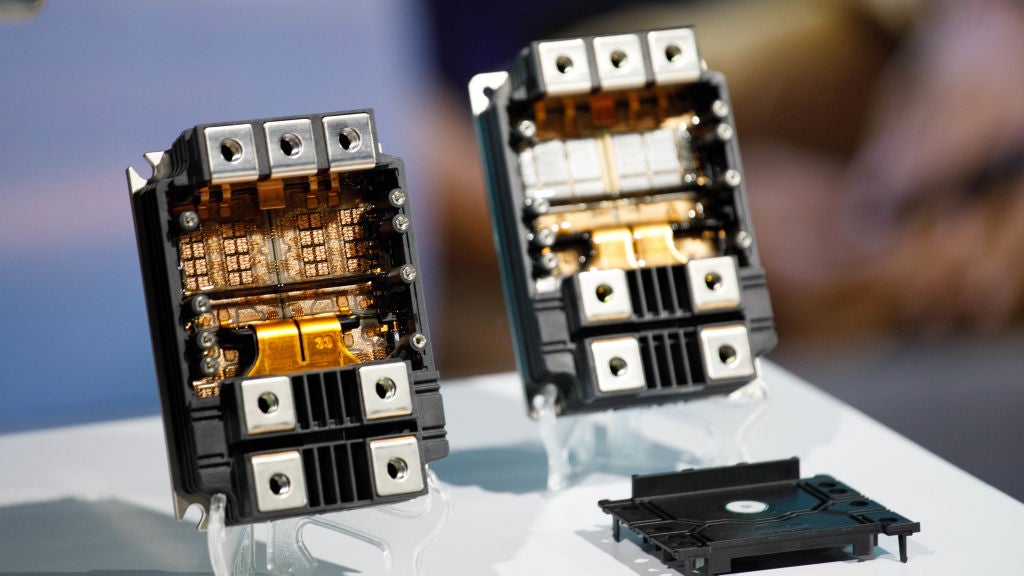

Axcelis, headquartered in Beverly, Massachusetts, has been providing solutions for the semiconductor industry for over 45 years. The company specialises in designing, manufacturing, and supporting ion implantation systems, which are crucial in the integrated circuit manufacturing process.

Veeco, headquartered in Plainview, New York, is engaged in manufacturing semiconductor process equipment, including technologies like laser annealing, ion beam deposition, and metal organic chemical vapour deposition (MOCVD). These technologies play a key role in the fabrication and packaging of advanced semiconductor devices.

The valuation of the combined entity is derived from the share prices of Axcelis and Veeco as of 30 September 2025, alongside existing debts from 30 June 2025.

Both Axcelis, listed on Nasdaq as ACLS, and Veeco, listed as VECO, conducted special meetings where stockholders voted in favour of the merger proposals. The outcomes of these votes will be reported through a Form 8-K filing with the US Securities and Exchange Commission by each company.

Under the terms of the agreement, Veeco shareholders will receive 0.3575 Axcelis shares for each Veeco share owned. Upon finalisation, Axcelis shareholders will own about 58% of the merged company, while Veeco shareholders will own approximately 42%.

Aimed at increasing market reach, the merger will integrate complementary technologies from both firms, potentially expanding their total addressable market to over $5bn. This expansion is largely driven by growth in AI and related power solution demands.

Additionally, the combined company will diversify its technology offerings and market segments to better support customer advancements, thereby becoming the fourth largest US wafer fabrication equipment supplier by revenue.

The merger’s financial benefits include anticipated revenue synergies through technology integration and cross-selling opportunities.

Axcelis and Veeco expect annual run-rate cost synergies of $35m within two years post-closing, with a substantial portion realised within the first year. On a pro-forma basis for fiscal year 2024, the combined company is projected to have generated $1.7bn in revenue with a non-GAAP gross margin of 44%, alongside an adjusted EBITDA of $387m.