Summary:

-

RBA Assistant Governor Sarah Hunter says labour market has stabilised but remains tight.

-

Bank closely assessing capacity pressures and inflation persistence.

-

Inflation expected to remain above 2–3% target for some time.

-

Recent slowdown driven by fewer vacancies and hiring, not higher unemployment.

-

Remarks reinforce Governor Bullock’s warning that further hikes remain possible

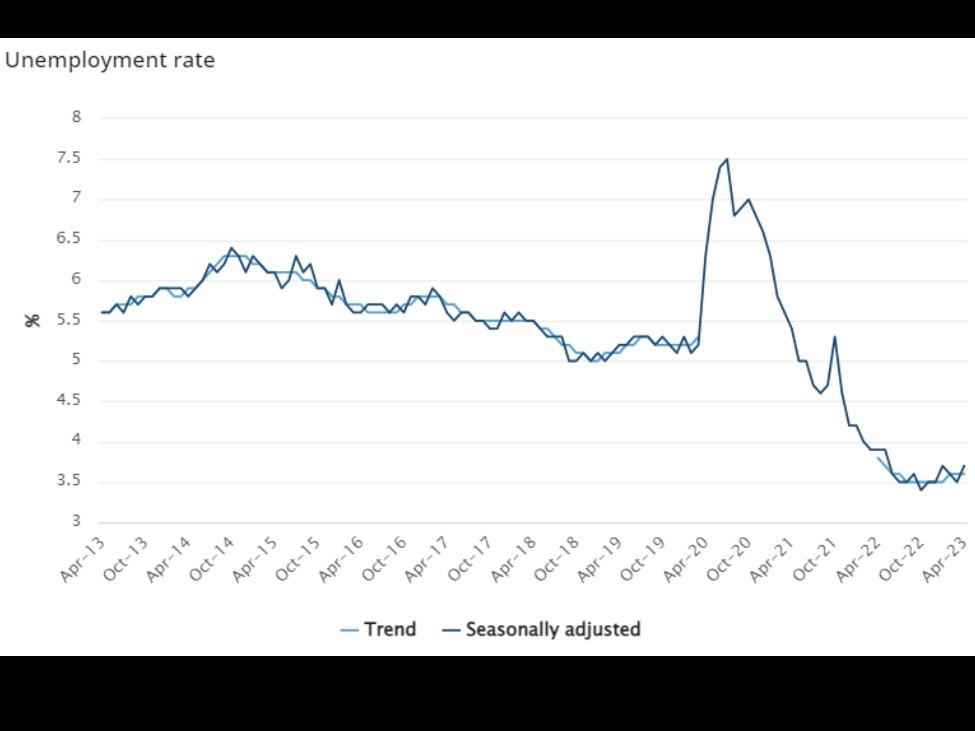

Reserve Bank of Australia Assistant Governor Sarah Hunter said the labour market has stabilised from its earlier slowdown but remains tight, a backdrop consistent with ongoing inflation pressures in the economy.

Speaking in Perth, Hunter said the RBA’s full-employment and NAIRU frameworks suggest the labour market has recently steadied and is “a bit tight,” underscoring the importance of closely monitoring capacity constraints. She emphasised that the central bank would be carefully assessing whether the recent rise in inflation proves temporary or more persistent.

Hunter described the economy’s dynamics as having evolved in recent months, but argued the overall picture still points to limited spare capacity. She likened the interaction between labour tightness and inflation pressures to an “entwined double helix,” signalling that wage dynamics and price pressures remain closely linked.

The comments follow the RBA’s decision last week to raise the cash rate by 25 basis points to 3.85%, reversing one of the cuts delivered last year. Underlying inflation accelerated to 3.4% in the most recent quarter, the fastest pace in more than a year, and is forecast by the RBA to rise to 3.7% over 2026, remaining above the 2–3% target band for some time.

Recent data have reinforced the narrative of a capacity-constrained economy. The unemployment rate unexpectedly fell to 4.1% in December, a seven-month low, suggesting conditions may have tightened again.

Hunter noted that much of the earlier moderation in labour conditions occurred through declining job vacancies, fewer job switchers and softer hiring intentions rather than a rise in unemployment — indicating adjustment has been relatively shallow.

Her remarks align closely with Governor Michele Bullock’s message that further rate increases remain possible if inflation becomes entrenched.