The U.S. labor market delivered a surprisingly robust performance to start 2026, adding 130,000 jobs in January—nearly double economists’ expectations—while the unemployment rate ticked down to 4.3%, according to data released Wednesday by the Bureau of Labor Statistics.

The strong headline figure reinforces the Federal Reserve’s case for keeping interest rates on hold through the remainder of Chair Jerome Powell’s term, which expires in May, as policymakers await clearer evidence that inflation is returning to target.

Key Takeaways

- Nonfarm payrolls: Added 130,000 in January (vs. 65,000-75,000 expected)

- Unemployment rate: Fell to 4.3% from 4.4% in December (matching expectations)

- Prior months revised: November revised down 15,000 to 41,000; December revised down 2,000 to 48,000 (combined -17,000)

- Annual benchmark revision: March 2025 employment level revised down 898,000 (seasonally adjusted) or 862,000 (not seasonally adjusted), reducing total 2025 job gains from 584,000 to just 181,000—the weakest year since the pandemic

- Wage growth: Average hourly earnings rose 0.4% monthly and 3.7% year-over-year, unchanged from December

- Sector leaders: Healthcare (+82,000), social assistance (+42,000), and construction (+33,000) drove gains, while federal government shed 34,000 jobs

January’s strong headline masked significant weakness revealed in the annual revision process. The 862,000-job downward adjustment for March 2025 marked the second-largest negative revision on record, exceeded only by a 902,000 reduction in 2009 during the financial crisis.

The revision showed 2025 job growth averaged just 15,000 per month—barely enough to keep pace with population growth. From July through December 2025, the economy actually lost 45,000 jobs on a revised basis.

Healthcare and social assistance continued their dominance, accounting for 124,000 of January’s 130,000 total job gains. This narrow concentration highlights ongoing concerns about the breadth of hiring across the economy.

Federal government employment has now declined 327,000 jobs, or 10.9%, since peaking in October 2024, as deferred resignation offers from 2025 continued to pull workers off payrolls.

Link to official U.S. BLS Non-Farm Payrolls Report (January 2026)

Policy Implications

January’s stronger-than-expected data makes near-term Fed rate cuts a lot less likely. The jobless rate is at 4.3%, just a hair above the Fed’s longer-run estimate, and the three-month average of private payrolls has improved to 103,000.

Powell has said the labor market is showing signs of stabilization, and this report backs that up. With inflation still at 2.7% and wages growing at 3.7%, there is little urgency for the Fed to ease.

Market Reaction

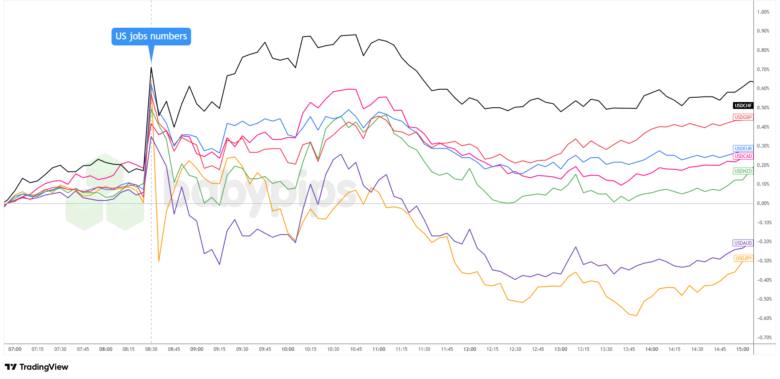

United States Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart Faster with TradingView

The U.S. dollar experienced volatile trading following the January jobs report, with multiple reversals reflecting shifting market interpretations.

USD, which had been edging higher pre-release, jumped 0.40%-0.60% against major currencies as the 130,000 headline doubled expectations. The Greenback surrendered half these gains within an hour as traders questioned the massive 862,000-job downward revision to March 2025, raising doubts about underlying strength.

USD regained momentum around 10:30 AM following hawkish remarks from FOMC member Jeffrey Schmid, who emphasized recent trends over backward revisions. It retreated near the London close before edging higher into the New York close.

By session’s end, USD posted mixed results, with gains against most majors except AUD and JPY.

The dollar’s strength likely reflected markets caught leaning bearish after weak ADP and layoff data. The unemployment rate drop to 4.3% and steady wage growth removed near-term Fed easing pressure, while the data validated Powell’s patient January stance.

Fed funds futures now price a 94% probability of unchanged rates in March, up from 80% pre-report, with first cut expectations pushed to June-July.

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high-quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top-rated journaling app! ($120 in savings)! Click here for more info!