Iren Limited (NASDAQ:IREN) is one of the under-the-radar AI stocks to buy. On February 6, Cantor Fitzgerald lowered the price target for Iren to $82 from $136 with an Overweight rating. The firm noted that revenue and adjusted EBITDA for the company’s FQ2 2026 declined quarter-over-quarter due to lower Bitcoin prices and a reduced operating hash rate, which was anticipated as the company transitions capacity from Bitcoin mining to AI compute. The firm viewed the subsequent after-hours decline in share price as a buying opportunity.

In FQ2, Iren Limited (NASDAQ:IREN) reported revenue of $184.7 million, which was a 23% decrease from the previous quarter, driven by lower Bitcoin mining revenue and a reduction in operating hashrate. This decline was partially offset by growth in AI cloud revenue following the commissioning of new GPUs at the Prince George site.

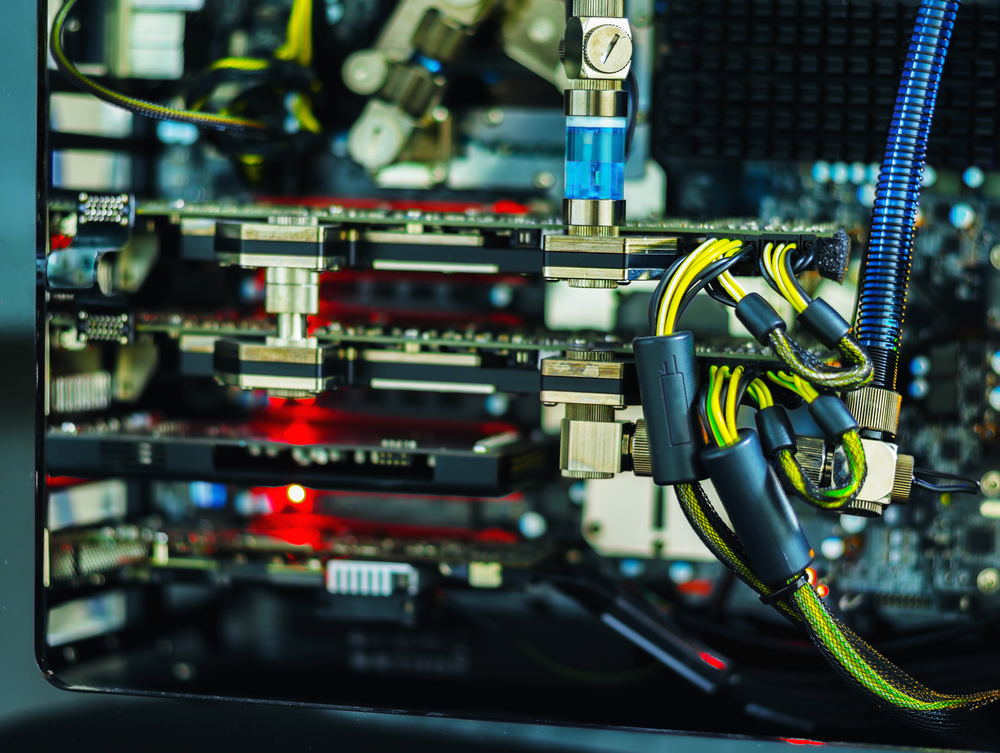

spacedrone808/Shutterstock.com

The company is strategically pivoting from Bitcoin mining toward AI compute, targeting an ARR (annualized revenue run rate) of $3.4 billion by the end of 2026. Currently, Iren has approximately $2.3 billion in ARR under contract, including a major $9.7 billion AI agreement with Microsoft that is expected to ramp up progressively throughout the year. To support this growth, the firm has expanded its secured power capacity to over 4.5 gigawatts, including a new 1.6 gigawatt site in Oklahoma.

Iren Limited (NASDAQ:IREN) operates in the vertically integrated data center business in Australia and Canada. It owns and operates computing hardware, as well as electrical infrastructure and data centers.

While we acknowledge the potential of IREN as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy Right Now.

Disclosure: None. This article is originally published at Insider Monkey.