This week, prediction markets offered a lesson in how quietly a market can spread across territories until it is virtually everywhere.

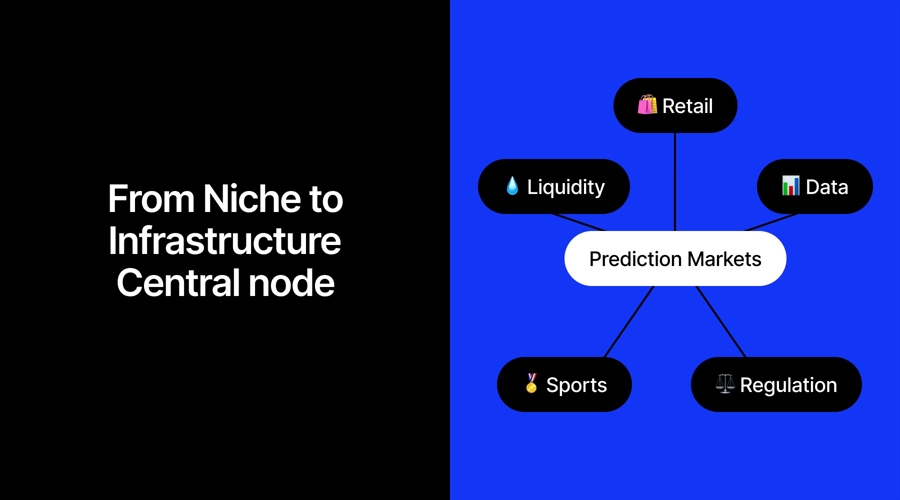

They have morphed from a niche experiment into a hybrid of betting, crypto culture, and online speculation almost before anyone could blink.

Now, event contracts are part of both the financial system and everyday life: retail brokerage flows, institutional trading desks, sports ecosystems, and data infrastructure.

Retail Engine Gains Traction

Event contracts have become a growth engine for Robinhood. More than 12 billion contracts were traded on the platform in 2025, including 8.5 billion in Q4 alone. Early January data suggests momentum is continuing into 2026. Notably, crypto trading revenue declined 38% year over year.

CEO Vlad Tenev has positioned prediction markets alongside equities, options, and banking products rather than as an experimental add-on. The signal is clear: for large retail brokers, event contracts are emerging as an engagement engine capable of offsetting weaker crypto activity.

Wall Street Steps In

Institutional players are moving deeper into the space. Proprietary trading firm Jump Trading is set to take small equity stakes in Kalshi and Polymarket in exchange for liquidity provision. The arrangements resemble venture-style deals and highlight the strategic value of market-making in event contracts.

Meanwhile, Intercontinental Exchange (ICE), owner of the NYSE, launched a Polymarket Signals and Sentiment tool that normalises and distributes prediction-market probabilities to institutional investors. Under the partnership, ICE acts as the exclusive distributor of Polymarket data for capital markets clients.

Sports and Esports Go Native

On the consumer side, integration into entertainment ecosystems is accelerating. Tournament organiser BLAST announced Polymarket as its official prediction partner for the 2026 season, marking what is believed to be the first major prediction-market sponsorship in esports. Markets will be integrated into broadcast segments and live events across BLAST’s Counter-Strike and Dota 2 tournaments.

In traditional sports, analysts estimate that prediction markets captured roughly 80% of year-on-year growth in Super Bowl wagering activity, operating under federal oversight by the Commodity Futures Trading Commission rather than state gambling regimes.

The competitive dynamic is shifting as prediction markets are operating under a different regulatory model.

The Competitive Edge: Regulation as Strategy

The Super Bowl data underscores a broader theme: regulatory positioning is becoming a competitive weapon. By framing themselves as federally regulated event-contract venues, platforms such as Kalshi have gained access to markets where traditional sportsbooks face state-level restrictions.

At the same time, incumbents are launching their own prediction-style products to defend market share.

The growth is not just product-driven. It is architecture-driven.

Bottom Line

This week’s developments point to one overarching trend: prediction markets are no longer a side experiment at the edge of crypto or betting culture. They are becoming embedded across retail brokerage apps, institutional data feeds, proprietary trading desks, and global sports entertainment.

From Robinhood’s volume surge to Jump’s liquidity deals, from ICE’s data integration to esports partnerships, prediction markets are evolving into a layer of financial infrastructure.

The least predictable outcome is about how quickly the markets built around those events become part of the system itself.

This article was written by Tanya Chepkova at www.financemagnates.com.

Source link