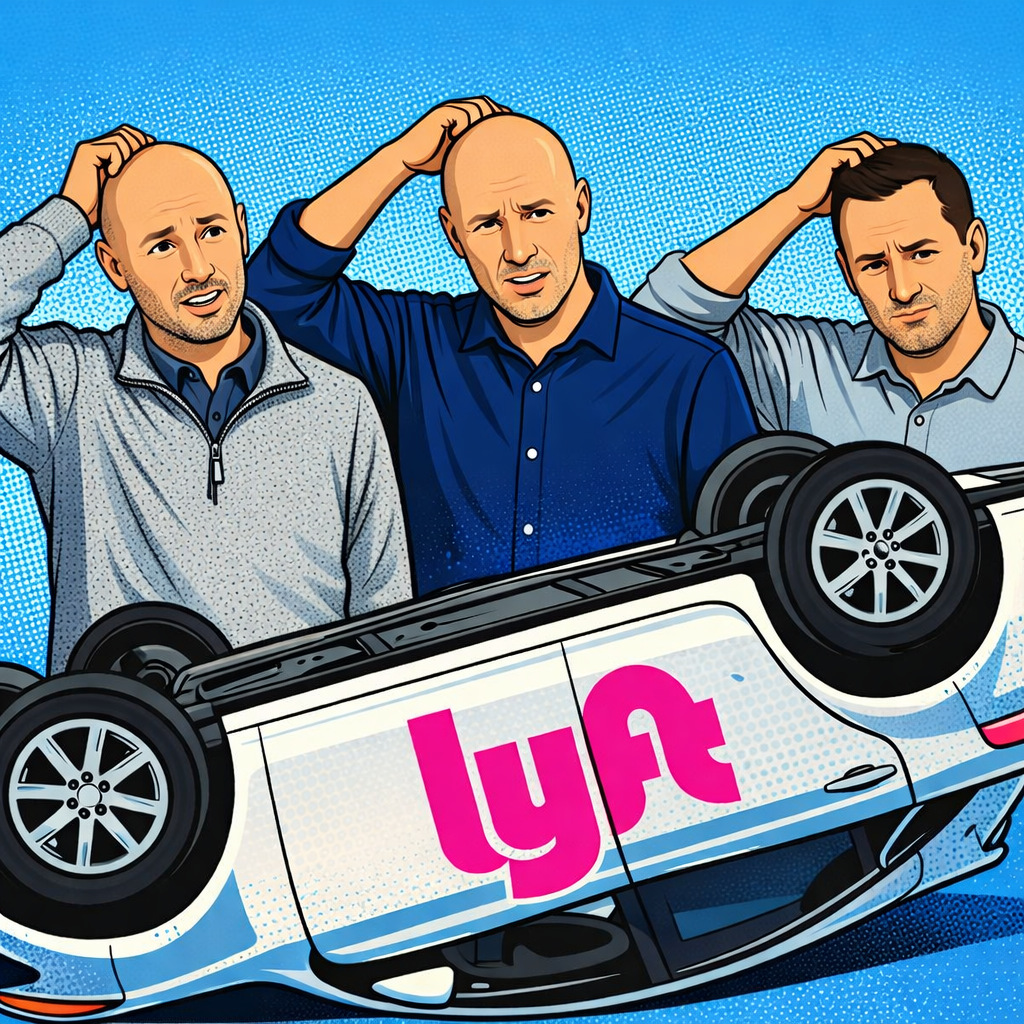

Lyft is getting smoked.

The ride-share company posted a weak quarter and the stock is down 16.5% as of mid-day Wednesday.

What makes the selloff interesting is that, on the surface, the numbers didn’t look bad. Gross bookings hit $5.1 billion, up from $4.3 billion in Q4 2024, a 19% year-over-year jump. Revenue came in at $1.59 billion versus $1.55 billion a year ago. Active riders climbed to 51.3 million from 43.5 million, an 18% increase.

Those are solid growth metrics.

Our analysts just identified a stock with the potential to be the next Nvidia. Tell us how you invest and we’ll show you why it’s our #1 pick. Tap here.

Then investors looked at net income, which jumped to $2.8 billion, up roughly 4,400% from last year.

That eye-popping spike in profit was largely driven by a technical accounting move called a valuation allowance release. Lyft has accumulated tax losses from prior years, and now that the business is more stable, it can reasonably expect to use those losses to offset future taxes. Accounting rules allow the company to recognize that future tax benefit today.

The result? A massive paper gain that didn’t add a single dollar of cash to the bank account. It looks like profit, but it’s not operating strength.

Wall Street saw through it.

As of writing, LYFT is trading at $14.08, still miles below its March 2021 high of $68.

One stock. Nvidia-level potential. 30M+ investors trust Moby to find it first. Get the pick. Tap here.