One of the biggest stories in the technology sector in 2026 is the “SaaSpocalypse.” This broad tech stock sell-off has been hitting well-known software-as-a-service (SaaS) companies like Salesforce, Adobe, and Microsoft.

Investors fear that powerful new artificial intelligence (AI) tools could disrupt the enterprise software industry. The premise is simple: Companies won’t need to buy as much software or subscribe for as many seat licenses as they used to because they can create their own software with AI, or use AI to produce similar results. If that’s true, software companies are about to become a lot less profitable.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

As a result, the iShares Expanded Tech-Software Sector ETF is now down 20% from where it traded a year ago, even as the tech-heavy Nasdaq-100 index is up 16%.

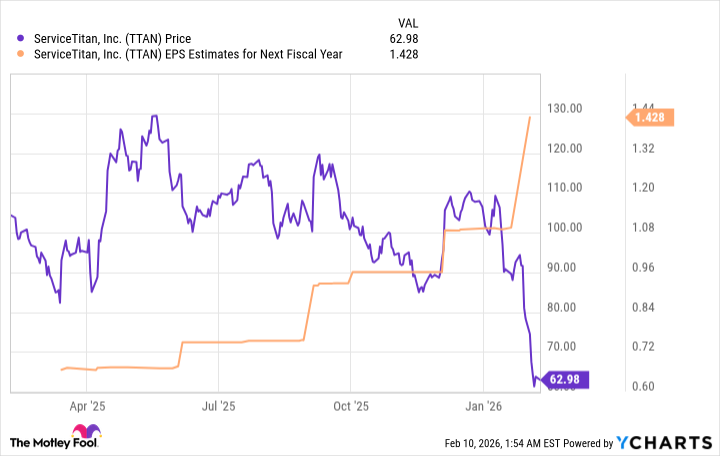

ServiceTitan (NASDAQ: TTAN) is one SaaS stock that might not be so vulnerable to the SaaSpocalypse. The company offers a specialized software platform that handles back-office functions specifically for skilled trades businesses such as contractors, carpenters, and plumbers. Although ServiceTitan stock is down 39% in the past year and 41% year to date, that sell-off seems overblown. Investors might be overreacting to AI hype and unfairly punishing the stock of a company with a bright future.

Here are a few big reasons why ServiceTitan could bounce back from the SaaSpocalypse.

If AI is truly on the verge of disrupting many software companies’ business models, that threat is not showing up yet in ServiceTitan’s earnings. The company reported strong results for its fiscal 2025 third quarter, with 25% year-over-year revenue growth. Its annual revenue run rate is almost $1 billion. And its non-GAAP (generally accepted accounting principles) operating margin in the most recent quarter was 8.6%, up from 0.8% in the prior-year period.

Like many early-stage tech companies, ServiceTitan is not profitable yet. But for four consecutive quarters, the company has also grown its revenue and beaten analysts’ estimates on earnings per share. Its earnings per share estimates have grown steadily — but the market seems to be undervaluing this stock because of the broader narrative about AI.

Here’s the bull case for why ServiceTitan won’t be disrupted by AI systems like Anthropic’s Claude Cowork: ServiceTitan makes software for an underserved niche market of AI-proof trade operations — HVAC companies, roofers, plumbers, construction firms, and other contractors providing residential and commercial services. These businesses often struggle to find off-the-shelf software solutions that meet their unique needs.