Sands Capital Management, LLC‘s Technology Innovators Fund released its Q4 2025 investor letter for “Technology Innovators Fund”. A copy of the letter can be downloaded here. The Fund delivered mixed performance during the fourth quarter of 2025, as market returns were increasingly driven by a narrow group of large-cap growth stocks, with the portfolio’s top ten holdings accounting for roughly 59% of assets, while several high-valuation innovation names faced pressure from slowing momentum and investor risk aversion. The fund’s results reflected stock-specific challenges rather than broad macroeconomic shocks, with weaker performance in certain emerging technology holdings offset by strength in select platform and infrastructure businesses. During the quarter, the portfolio declined 6.3% on a quarter-to-date basis, and the fund generated a 14.7% return over the one year, reflecting stock-specific challenges rather than broad macroeconomic shocks, with weaker performance in certain emerging technology holdings offset by strength in select platform and infrastructure businesses. Management emphasized its long-term investment horizon, noting an average annual portfolio turnover of 21%, and stated that many portfolio companies continued to generate solid full-year earnings growth in 2025, supported by durable revenue models tied to artificial intelligence, cloud computing, and digital transformation, even as enthusiasm for speculative growth faded late in the quarter. In addition, please check the Fund’s top five holdings to know its best picks in 2025.

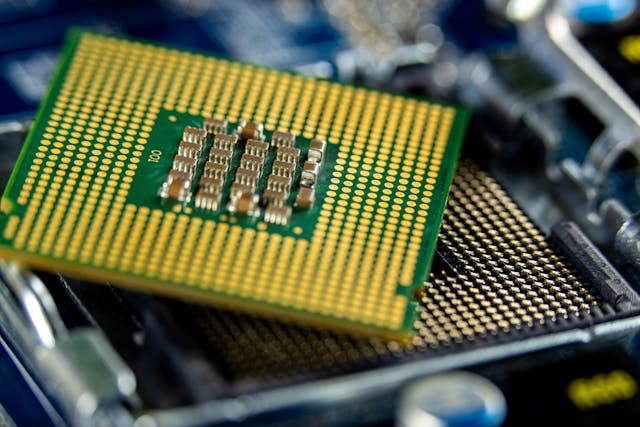

In its fourth-quarter 2025 investor letter, Sands Capital Technology Innovators Fund highlighted stocks like Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM). Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is the world’s leading contract chip manufacturer, producing advanced semiconductors for major global technology companies. The one-month return of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) was 11.99% while its shares traded between $134.25 and 380.00 over the last 52 weeks. On February 13, 2026, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) stock closed at approximately $368.10 per share, with a market capitalization of about $1.91 trillion.

Sands Capital Technology Innovators Fund stated the following regarding Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in its Q4 2025 investor letter:

“Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is the world’s largest producer of leading-edge logic chips by market share. The company reported strong results for the most recent quarter. It continues to execute well on advanced-node yield improvements and capacity expansions to meet accelerating AI compute demand. TSMC remains a key beneficiary of this trend. New AI-related partnerships announced over the past several months support a growing multi-year revenue pipeline. Taiwanese media also reported potential price increases for 5nm and more advanced nodes next year, which could provide a meaningful revenue tailwind in 2026. We view the company as one of the strongest fits with our investment criteria, supported by its leadership in advanced manufacturing, deep customer relationships, and growing role in enabling next-generation technologies.”