In the race to lead the innovation narrative, the US healthcare industry needs to actively consider systemic changes to contend with the growing competition from China, say industry experts.

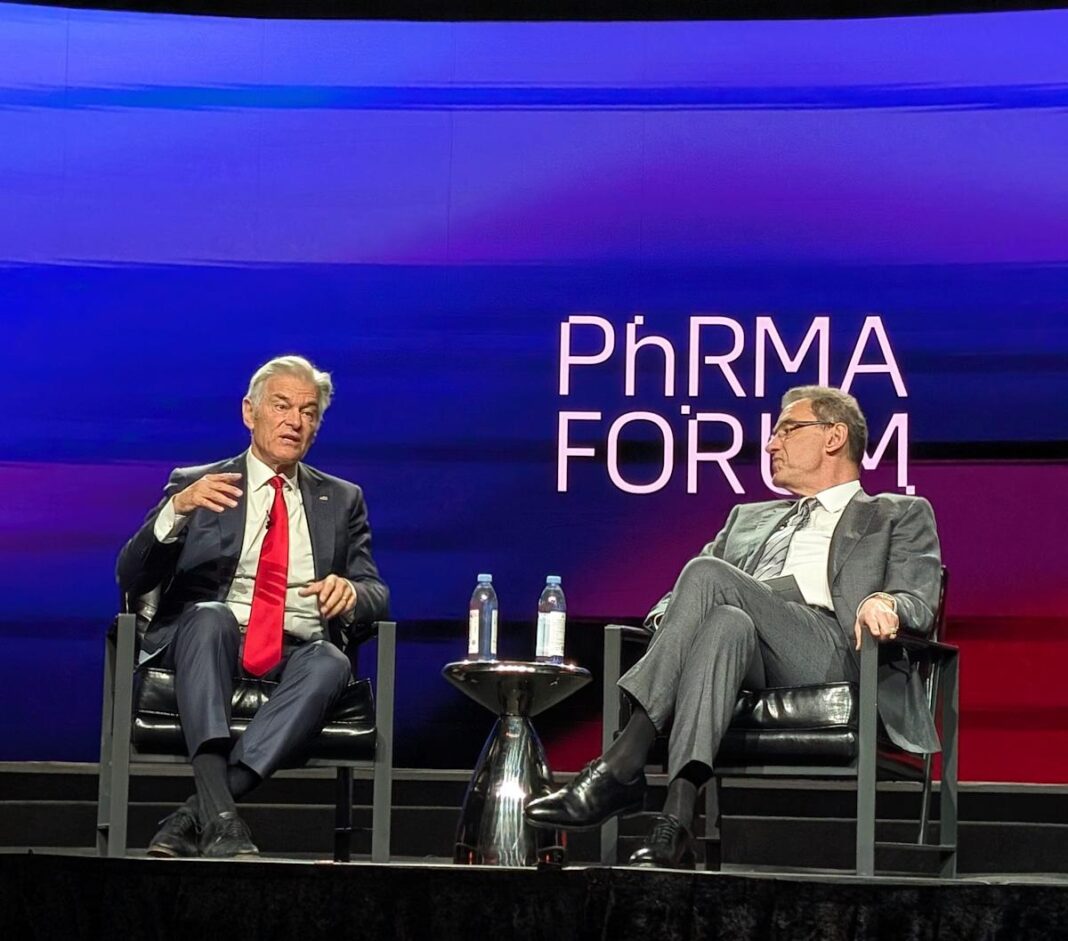

At the glitzy event organised by the lobbying group PhRMA on 17 February in Washington DC, several administration leaders mingled with leading pharma and biotech executives to discuss the latest trends and challenges in the pharmaceutical sector.

The chief topic on the agenda for all was China; with PhRMA and others ringing alarm bells that China’s healthcare industry is quickly moving ahead on key metrics like the pace and cost of Phase I trials, and share of innovative therapies in development.

Dr Mehmet Oz, administrator for the Centers for Medicare and Medicaid Services (CMS), drew on the ongoing Winter Olympics to paint a metaphor. In a skating race, when a competitor is close behind, he said, “You don’t try to block them out”. That strategy would not differentiate from competitors, he stated. But rather the US needs to “streamline the process” of generating an idea and taking it to the clinic, and all the different elements involved in that are critical, he said. Whether it be improving the ratio of approved drugs or the CMS engaging with patients earlier once a drug is approved, potentially through value-based contracts, several opportunities exist, he said.

“It is imperative that we [the US] maintain hegemony with the innovative leadership that already exists in the pharmaceutical sector…[broadly] in health sciences,” he added.

Ex-FDA commissioner Scott Gottleib, currently a venture capitalist at the NEA group, called out the changing innovation landscape, saying: “46% of the development around mRNA vaccines right now is taking place in China, a technology that was largely invented here in the US… Right now, we’re in a position where we’re actively [I think] eroding part of our vaccine enterprise.” On these lines, later in the day, current FDA Commissioner Dr. Marty Makary fielded questions on the agency’s recent position of issuing a refusal to file (RTF) to Moderna for its mRNA flu vaccine, a decision that has garnered industry criticism. On the China question, Makary said the US needs to “be as competitive as we can be”.

Nonetheless, Chinese biotechs are “extremely dependent” on US capital and the US market to make the economics of their ecosystem work, said Franck Le Deu, founder & managing partner at KerZheng Ventures. Le Deu highlighted the predictability and direction provided for the industry with the government’s long-term plans, in addition to engineering expertise and work ethic of individuals in the workforce as key reasons for China’s success in this sector. The evolving changes on the international stage offer a chance for others to learn from the China, he said, while reemphasising that the healthcare industry is a global one.