Plus500 recently revealed that its non-over-the-counter (non-OTC) revenue for 2025 exceeded $100 million and now accounts for about 14 per cent of the group’s total revenue. This surge came from no non-OTC revenue just a couple of years ago.

The growing revenue clearly shows how the contracts for difference (CFD) broker is expanding its footprint beyond its core revenue stream, which is still CFD.

CFD Brokers Push for Non-OTC Revenue

The trend to push non-CFD offerings is seen among other brokers as well. According to a recent Acuiti survey conducted for CME Group, four out of five firms that do not yet offer listed derivatives are either planning to or actively considering doing so.

IG Group, which has been offering non-OTC trading revenue for years, is also witnessing strong growth in its figures in recent years.

The reason behind Plus500’s and IG’s push into non-OTC revenue is the same: their entry into the US futures and options market.

IG first entered the US market by acquiring tastytrade for $1 billion in mid-2021, a platform with a large user base. Under the new owner, the US-focused platform also grew strongly: its revenue doubled to over £200 million compared to the pre-acquisition pro forma figure of £100.6 million.

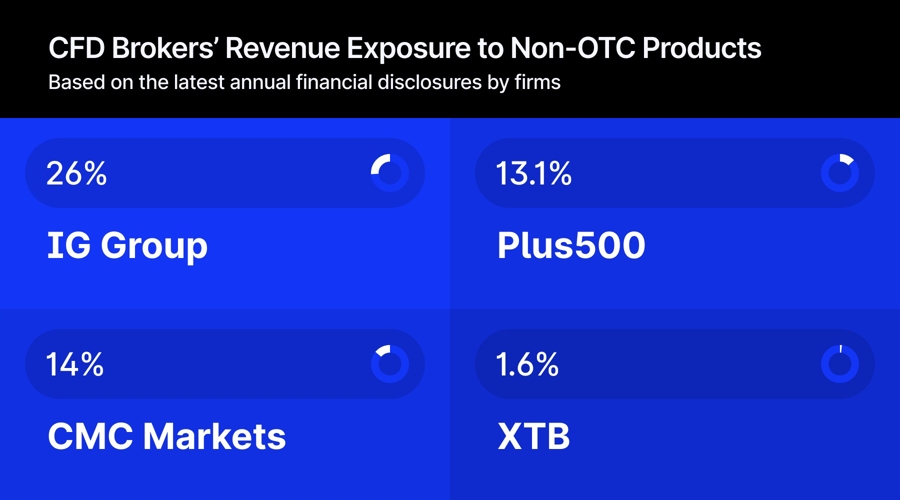

The performance of tastytrade also helped IG boost its non-OTC revenue, which the company reports as revenue from exchange-traded derivatives (ETD) and stock trading investments. The London-listed broker generated £191 million from non-OTC streams in the last fiscal year, compared to £63.1 million in the year prior to its tastytrade acquisition.

The ETD stream was also boosted by IG’s launch of Spectrum Markets in Europe, but the platform was closed last year. IG, meanwhile, entered the non-OTC market after the global financial crisis through its acquisition of HedgeStreet, which was later rebranded as Nadex.

Read more: How Does Shifting to Futures and Options Affect Broker Revenue?

Following the US Playbook

Plus500, on the other hand, operated largely as a pure-play CFD provider. It began diversifying into non-OTC products with the 2021 rollout of Plus500 Invest, a futures and share-dealing platform in some European markets. It later expanded its non-OTC offering with the acquisition of Cunningham Commodities, which gave it access to the US futures markets. It now offers retail services there under the Plus500 Futures brand.

Despite entering non-OTC markets after the COVID-19 pandemic, the broker started to report its non-OTC revenue only in 2024, when it generated $76.8 million from this stream, about 10 per cent of its total revenue. It can be assumed that, before non-OTC revenues appeared on the company’s financials, business from those streams was negligible.

Plus500 is now also eyeing the regulated Indian derivatives market. It closed the $20 million acquisition of a local derivatives broker earlier this month, but did not share details of its plan for the most populous country. Notably, India is the largest derivatives market in terms of average daily turnover.

Meanwhile, retail demand for futures and options trading in the US is also growing. In 2024, total US options volume jumped 10.6 per cent. By Q3 2025, Cboe said overall listed-options activity was running at record levels (59 million contracts per day through September 2025) and linked part of the surge to rising retail engagement.

Non-OTC, but in Non-US Markets

CMC Markets is among the early entrants in the non-OTC markets. Its expansion beyond CFDs dates back to 2008, when it entered Australian stockbroking following the acquisition of Andrew West & Co, which became CMC Stockbroking.

Lord Peter Cruddas-led platform has maintained a double-digit share from its non-OTC revenue for years. In the last fiscal year, non-OTC streams, which are mainly investing services for this platform, brought in £44.4 million, 13.1 per cent of its total revenue. This share improved to 14.1 per cent in the first six months of the ongoing fiscal year.

Related: CMC Markets Joins Other CFD Brokers with “Super App” Ambition, Floats a 3-Phase Plan

For Switzerland’s Swissquote, however, securities trading is core, generating almost 86 per cent of its total revenue in 2024.

Meanwhile, like Plus500, Poland’s XTB, which remained CFD-focused for years, is now slowly expanding into non-OTC products, including stocks and exchange-traded funds (ETFs). However, only 1.6 per cent of its total 2024 revenue came from non-OTC streams, although this was up from 0.7 per cent.

The push by Plus500 and IG Group towards non-OTC futures trading shows two things: the need for these brokers to diversify beyond CFDs, and the strong demand in the US retail futures trading market.

FinanceMagnates.com also recently pointed out that moving from OTC CFDs to exchange-traded futures and options changes how brokers generate revenue and what risks they face. Although CFDs are high-margin products because the broker controls pricing and internalisation of trades, they are heavily scrutinised by regulators.

However, revenue from non-OTC products is driven mainly by commissions and exchange fee mark-ups rather than by client trading losses. Margins per contract are typically thinner but more predictable. Brokers do not control spreads in the same way as in OTC products because prices are formed in a central order book.

Despite the growing popularity of non-OTC markets, big CFD brokers are also expanding into institutional services, as many operate as prime brokers and liquidity providers. Plus500 is even directly and indirectly entering new markets, such as prediction markets and prop trading.

This article was written by Arnab Shome at www.financemagnates.com.

Source link