AvalonBay Communities, Inc. (NYSE:AVB) is included among the 14 Best Real Estate Stocks to Buy According to Hedge Funds.

On February 13, Citi analyst Nicholas Joseph lowered his price recommendation on AvalonBay Communities, Inc. (NYSE:AVB) to $198 from $212. The analyst maintained a Neutral rating on the stock.

A few days earlier, on February 9, Cantor Fitzgerald also updated its view on AVB, raising its price target to $186 from $179 but maintaining a Neutral rating. The analyst noted that the five multifamily REITs under coverage reported fourth-quarter results that came in below consensus expectations. However, he added that the more important indicator going forward would be new lease rate growth, especially as the market moves into the key spring and summer leasing season.

During the company’s Q4 2025 earnings call, CEO Benjamin Schall said the results reflected the overall strength of AvalonBay’s portfolio, along with the steps the company had taken to support growth and the effectiveness of its operating teams. He highlighted strong resident retention, noting that turnover came in at 41%, the lowest level the company has ever recorded.

Schall also said the company launched $1.65 billion in new development projects, which are expected to deliver an initial stabilized yield of 6.2%. In addition, AvalonBay raised nearly $900 million in equity on a forward basis, with an implied initial cost of about 5%. He added that the company also repurchased nearly $490 million worth of its own shares, at an average price of $182 per share, reflecting confidence in its long-term outlook.

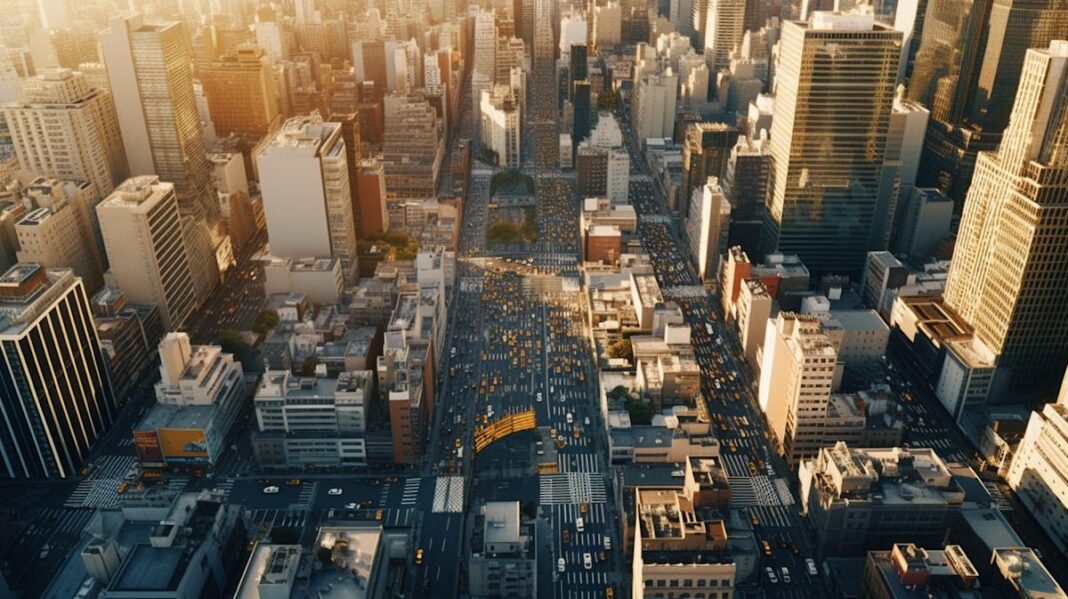

AvalonBay Communities, Inc. (NYSE:AVB) is a real estate investment trust that focuses on developing, acquiring, redeveloping, and managing apartment communities. Its operations are organized across Same Store, Other Stabilized, and Development/Redevelopment segments.

While we acknowledge the potential of AVB as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: 13 Best Roth IRA Stocks to Buy Now and 16 Best Dividend Stocks with Rising Payouts

Disclosure: None.