Nuclear power is enjoying a renaissance both in the U.S. and around the world right now.

Between the power demands of artificial intelligence (AI) and a desire for green energy without the limitations of solar and wind, countries around the world are investing heavily in their nuclear capacity.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Demand for uranium, the spicy yellow rock those nuclear reactors rely upon, has surged in the past year and uranium’s spot price has surged 32% over the past 12 months as the prices of almost every other energy resource has fallen.

And Saskatoon, Saskatchewan-based Cameco (NYSE: CCJ) remains my favorite way to play the nuclear bull market. The stock is up 128% over the past year but recently stumbled back down below $120 which has created a buying opportunity for the company. Here’s why.

Cameco’s core business is pretty simple. It mines and refines uranium for use in nuclear reactors around the world. But there’s a bit more to it than that.

First, Cameco is actually the second largest uranium producer in the world behind Kazakhstan’s Kazatomprom. In 2025, Cameco produced 15% of all global uranium for the year.

Second, Cameco holds both one of the world’s highest grade uranium mines in Cigar Lake and the world’s largest high-grade uranium mine in MacArthur River/Key Lake.

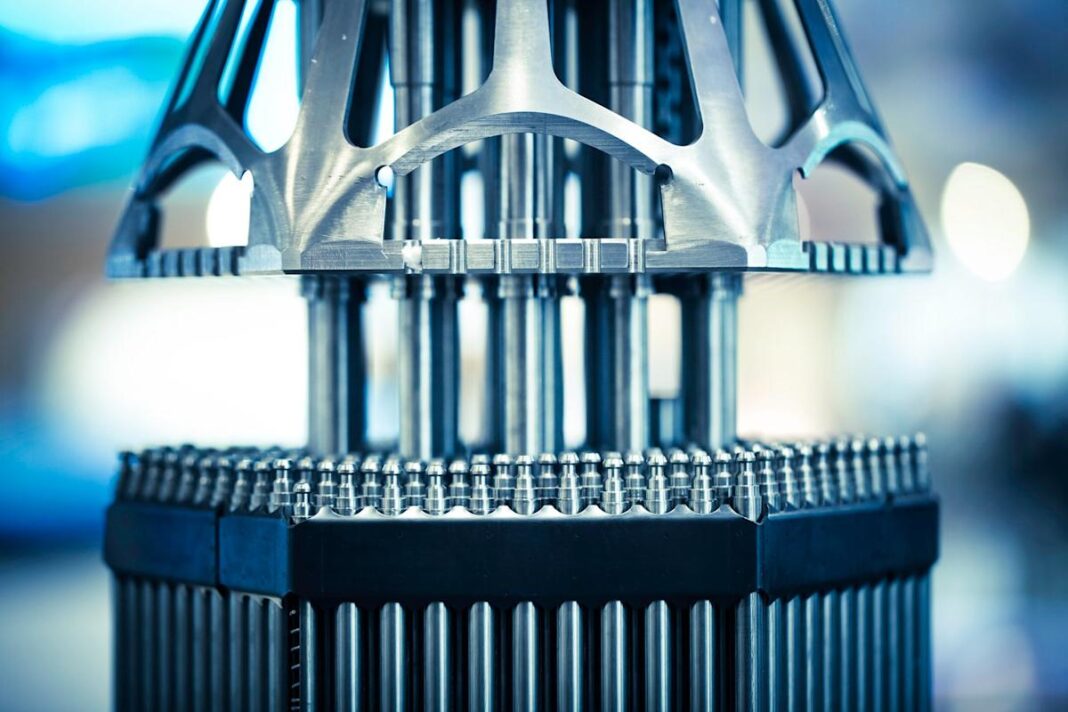

Third, in addition to uranium mining and refining, Cameco is also present in the nuclear reactor business through its 49% share in Westinghouse, an engineering company that produces both the world’s most advanced commercially available nuclear reactor in the AP 1000 and is developing a small modular reactor (SMR) dubbed the AP 300.

The company is uniquely well-positioned to provide uranium and reactors to fuel the U.S. Department of Energy’s plan to triple America’s nuclear energy generation by 2050. Canadian uranium, a major carveout in the Trump administration’s tariffs, is taxed at 10% as opposed to 25%.

Further, the administration struck an $80 billion deal with Cameco and Westinghouse’s other owner Brookfield Asset Management, which will see the U.S. purchase new AP 1000 reactors for its own fleet.

It’s not just the U.S., either. China has 14 AP 1000 reactors under construction, Poland has contracts for three, Bulgaria for two, Ukraine for nine, and India for six. It’s also worth noting that Westinghouse is beginning to pay off as an investment for Cameco. For 2025, it went from a net loss of $218 million to a net profit of $58 million.