Grail (GRAL) shares were cut in half on Feb. 20 after the biotech firm said its highly anticipated NHS-Galleri clinical trial failed to meet its primary endpoint.

As retail and institutional investors bailed on GRAL today, its 14-day relative strength index (RSI) crashed to 24, indicating a technical rebound was likely in the near term.

Still, investors are recommended against buying the dip in Grail stock, even though it looks like a bargain at about $49.

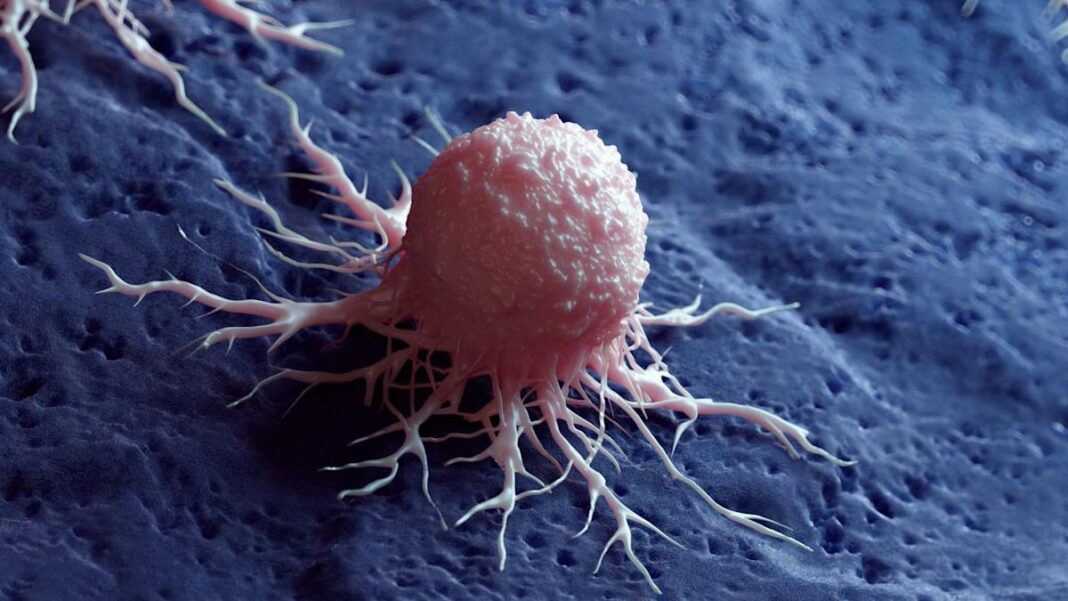

NHS-Galleri was a massive 142,000-participant trial intended to validate Grail’s multi-cancer early detection (MCED) test.

Its failure to meet the primary goal of a statistically significant reduction in combined Stage III and IV cancer diagnoses hurts GRAL stock because it weighs on MCED’s immediate commercial and regulatory trajectory.

Without a clear win in this “landmark” study, the path toward universal adoption by national health systems, and the high-margin revenue that follows, is now shrouded in uncertainty.

Grail is unattractive to buy on the dip also because it crashed through all of its key moving averages (MAs) today, signaling bears have firmly taken control across multiple timeframes.

Beyond this clinical failure, the bearish narrative for Grail shares is underpinned by what can only be described as a grueling financial reality.

While the biotech firm beat quarterly loss estimates, it’s yet to turn a profit and is burning through hundreds of millions in cash annually.

With a return on equity (ROE) of minus 16.8%, GRAL looks overvalued relative to peers at a price to sales (P/S) multiple of about 25.

Investors must also contend with a “higher-than-anticipated” incidence of Stage III cancers in the study and a $22 billion debt overhang in the broader sector that limits refinancing options.

Note that Grail has historically lost over 30% on average in March, which makes it significantly less attractive as an investment today.

Heading into Friday, Wall Street analysts had a consensus “Moderate Buy” rating on GRAL shares with a mean target of about $114.

However, it’s reasonable to assume that downward revisions will follow now that its NHS-Galleri trial has failed.