The iShares MSCI Global Silver and Metals Miners ETF (NYSEMKT:SLVP) and VanEck Gold Miners ETF (NYSEMKT:GDX) both provide access to global mining stocks, but SLVP focuses on silver and diversified metals, while GDX zeroes in on gold miners.

The two ETFs are great options for investors seeking exposure to metals and mining, but they differ on several factors, including cost, yield, liquidity, risk, sector emphasis, and portfolio makeup. The comparison below looks at these differences to help investors decide which ETF may appeal more to them.

|

Metric |

SLVP |

GDX |

|---|---|---|

|

Issuer |

IShares |

VanEck |

|

Expense ratio |

0.39% |

0.51% |

|

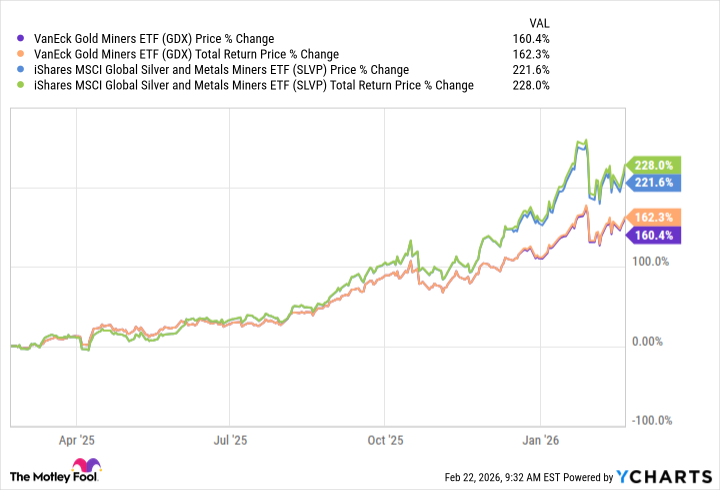

1-yr total return (as of 2026-02-21) |

228% |

162.3% |

|

Dividend yield |

1.5% |

0.6% |

|

Beta |

0.63 |

0.41 |

|

AUM (as of 2026-02-20) |

$1.3 billion |

$33.5 billion |

Beta measures price volatility relative to the S&P 500; beta is calculated from five-year weekly returns. The 1-yr return represents total return over the trailing 12 months.

SLVP is more affordable, charging a 0.39% expense ratio compared to GDX at 0.51%. SLVP also pays out a higher dividend yield at 1.5%, while GDX yields 0.7% — a notable gap for income-focused investors.

|

Metric |

SLVP |

GDX |

|---|---|---|

|

Max drawdown (5 y) |

-56.18% |

-49.79% |

|

Growth of $1,000 over 5 years |

$2,718 |

$3,246 |

GDX holds 55 names and tracks global gold miners, with all assets in the basic materials sector. Its largest positions are Agnico Eagle Mines (NYSE:AEM) at 9.73%, Newmont Corp (NYSE:NEM) at 9.11%, and Barrick Mining Corp (NYSE:B) at 6.65%. With nearly $33.5 billion in assets under management and a 19.7-year track record, GDX stands out for scale and liquidity.

SLVP also sits squarely in the basic materials sector, but its top holdings—Hecla Mining (NYSE:HL) at 15.38%, Indust Penoles at 11.9%, and Fresnillo Plc at 10.94%—show a clear tilt toward silver. SLVP holds 30 companies and manages $1.3 billion in assets, making it smaller and more concentrated than GDX.

For more guidance on ETF investing, check out the full guide at this link.

Precious metals have seen significant momentum in recent months, with prices of both gold and silver hitting all-time highs in January 2026. The choice between the iShares MSCI Global Silver and Metals Miners ETF and the VanEck Gold Miners ETF boils down to which precious metal an investor is seeking exposure to.

GDX is arguably the best ETF for investing in gold mining stocks without the risks and hassle of analyzing and investing in individual stocks. With over $30 billion in assets under management (AUM) and 55 global stocks, it offers superior liquidity and diversification within the gold mining industry. Newmont, Agnico Eagle, and Barrick are the world’s three largest gold miners.