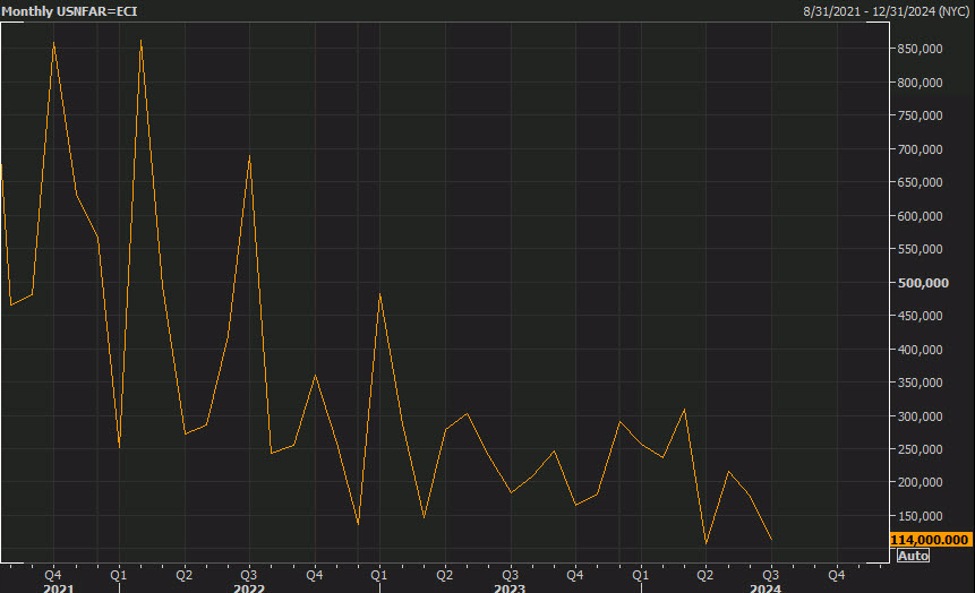

non-farm payrolls

Ian Lyngen is a great fixed income strategist and today he weighs in on the huge bid in bonds and what it would take to make a 50 basis point cut as the baseline:

“The Treasury market is

pricing in a weaker employment report than we’re likely to see,” he writes. “To be fair, we are in the

cooling economy/employment camp, but simply view current levels as anticipating

more dramatic near-term downside.”

The consensus for Friday’s jobs report is +160K with a 4.2% unemployment rate.

“A popular question among market participants at

the moment is what degree of employment downside would be needed to justify a

50 bp cut?